Gauntlet Ends Relationship with Aave Due to Disagreements with Community

John Morrow, the co-founder of Gauntlet, stated today that the risk management company will terminate its four-year partnership with the decentralized finance (DeFi) lender, Aave.

“In the four years we have collaborated with Aave, much has shifted,” Morrow penned in a post on Aave’s governance forum. He mentioned that in the last year, dealing with the shifting guidelines and unwritten goals of the major stakeholders has been challenging.

This development implies that Ethereum’s largest DeFi protocol is now on the hunt for a new overseer for crucial protocol parameters and decisions. The public resignation and the ensuing debate also highlight the different operation modes of decentralized autonomous organizations compared to traditional companies.

For more DeFi and Web3 news, visit thedefiant.io

Starknet’s $2 Billion Airdrop Marks Crypto’s Largest Ever

Starknet, an Ethereum Layer 2 network, debuted its highly anticipated token yesterday with a 700 million STRK airdrop for developers and early users.

The STRK token launched at over $3, placing the project’s value over $30 billion on a fully diluted basis and making the airdrop value $2.1 billion – the biggest in the history of crypto.

For more DeFi and Web3 news, visit thedefiant.io

Ethena Stablecoin’s 27% Yield Causes Terra-Related Concerns

Ethena Labs, a synthetic stablecoin startup, has drawn attention after announcing it will provide over 20% yield on its USD-pegged token.

Ethena’s Labs’s USDe stablecoin offers a 27% yield, and has been available to the public since February 19, when the mainnet and Etherena’s “Shard Campaign” went live.

According to the team, users can choose between staking USDe and receiving yield generated by the protocol from stETH and short ETH positions funding rates, or accumulating “shards” that reward a user based on their contribution to the ecosystem. Shards are earned by providing liquidity to Curve.

For more DeFi and Web3 news, visit thedefiant.io

Avalanche Experiences Surge with Memecoins, GameFi, and RWAs

Activity is increasing on Avalanche, a leading Layer 1, with memecoins, web3 games, and real-world assets contributing to the network’s significant growth.

A report from Flipside Crypto, a crypto analytics firm, released on February 21, shows Avalanche-native memecoins increasing on-chain activity in Q4 2023. Avalanche’s daily on-chain transactions peaked at $6.4M on November 22, with a secondary spike to 6.3M on December 19.

The report also shows a surge in GameFi activity resulting in a more than 300% increase in daily active users on Avalanche subnets since October. The number of active wallets on Avalanche subnets escalated from 9,994 on October 1 to 40,497 on February 7.

For more DeFi and Web3 news, visit thedefiant.io

Wormhole Partners with AMD in Light of Zero-Knowledge Development

Wormhole, a cross-chain interoperability protocol, is collaborating with AMD, a major semiconductor and computer processor manufacturer, to implement its zero-knowledge roadmap.

Announced on February 21, the partnership will enable Wormhole and projects within its ecosystem to utilize AMD’s enterprise-grade Field Programmable Gate Array (FPGA) hardware accelerators.

The hardware, including the AMD Alveo U55C and U250 adaptable accelerator cards, can be specialized in zero-knowledge (ZK) proof generation. This follows Wormhole’s announcement of its ZK-focused development roadmap on February 1.

For more DeFi and Web3 news, visit thedefiant.io

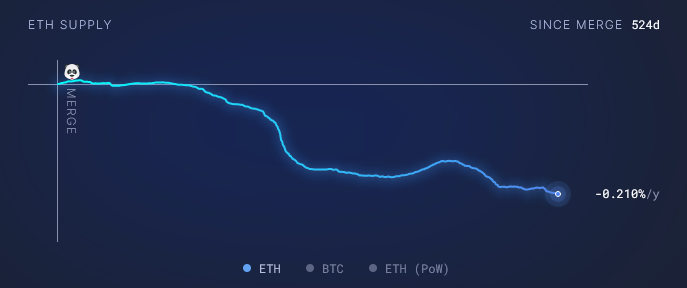

Ethereum On-Chain Activity Leads to Surge in Burn Rate

Ether’s circulating supply is at a new post-merge low following a recent increase in gas fees that escalated Ethereum’s burn-rate.

According to data from Ultra Sound Money, the supply of Ether is now below 120.16M after over 21,000 ETH worth $62.8M were burned in the past two weeks. Since the activation of Ethereum’s Shanghai upgrade, also known as The Merge, in September 2022, Ether’s supply has decreased by 362,628 ETH.

For more DeFi and Web3 news, visit thedefiant.io

Understanding Restaking

The crypto markets have started 2024 strongly, and with prices on the rise, market participants are searching for promising investment opportunities within DeFi. EigenLayer, among new protocols and DeFi elements, has been garnering interest with its introduction of Ethereum restaking.

Restaking via EigenLayer allows Ethereum stakers to earn extra yield by securing third-party Actively Validated Services (AVSs) while also validating the Ethereum network. Users can participate either by directly restaking Ether or by depositing Liquid Staking Tokens (LSTs) like Lido’s stETH.

This utilization of staked ETH allows users to engage in multiple ecosystems with the same assets, thus enhancing capital efficiency for stakers. New projects can use EigenLayer to secure themselves instead of allocating resources to establish their own validator sets.

For more DeFi and Web3 news, visit thedefiant.io